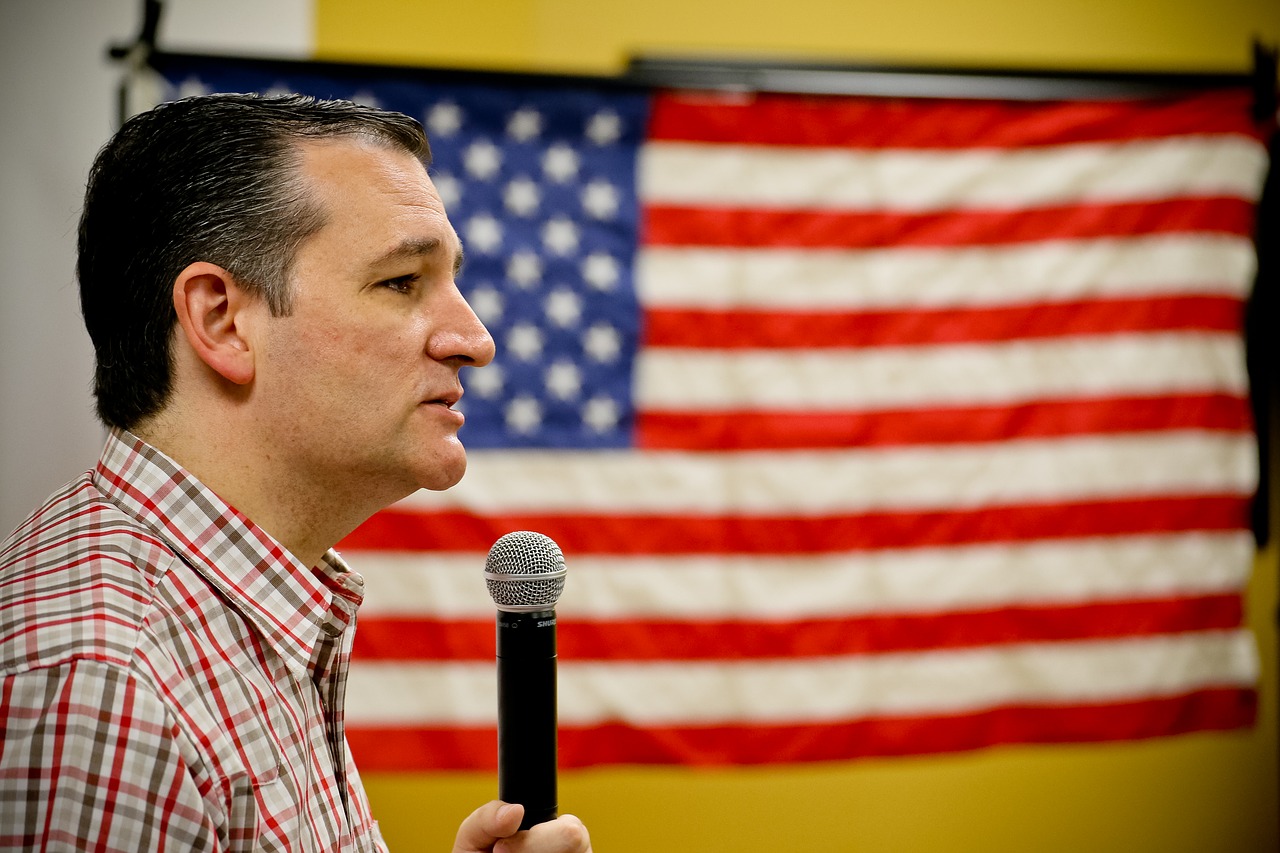

Ted Cruz has challenged a federal election law that limits how candidates can, in fact, recoup loans they make to their own campaigns. It has reached the U.S. Supreme Court.

Ted Cruz and the High Court Docket

On Thursday, the high court added Federal Election Commission v. Ted Cruz for Senate, et al. to the docket. That is if the justices do affirm lower courts’ rulings in favor of the Texas Republican, would case would mark another conservative legal victory that strikes down campaign spending limits under the First Amendment.

More than $250,000 contributions were collecting after an election, under a 2002 federal law. It may, in fact, have been using to repay a candidate’s loan to their campaign. Cruz was locking in a close battle with the-U.S. Representative Beto O’Rourke. This was before the 2018 election. Moreover, Cruz loaned $260,000 to his campaign.

Ted Cruz Lawyers Question Law

Cruz’s lawyers have argued the law does deter candidates from loaning the money to their campaigns by restricting their ability to get it back in a motion that was filed on August 6th.

“In fact, the loans could still be repaid in full with funds that were raised previously to the election. However, there is no question about Section 304’s limit. It would be substantially increasing to risk that any candidate loan will never be fully repaid. It would, moreover, force a candidate to really think twice before making those loans in the first place,” they wrote.

Quid pro quo Corruption

The law, the members of congress did pass, was in part, to prevent the appearance of quid pro quo corruption. It was when a recently electing member of Congress is, therefore, collecting contributions that would be repaying to the member’s personal funds. Appointed by former President Donald Trump, Judge Neomi Rao, to the D.C. Circuit Court of Appeals, wrote the government did not prove how it was going to achieve that goal.

Loan-Repayment Limit

“Loan-repayment limit will serve as an interest in preventing quid pro quo correction because the government has failed to demonstrate. That limit is actually tailoring to go ahead and thus serve this purpose. Moreover, the loan repayment limit does run afoul of the First Amendment,” Rao wrote for the three-judge panel of the U.S. District Court for the District of Columbia.